After each devotional there is a simple prayer or response in this book. Here's what it said:

God, thank you for inviting me into your presence, welcoming me to turn to you with my dreams and desires. Please show me how to use these desires of my heart in this world for your glory.

So I got to thinking... what desires and dreams do I have? And how can I use them to glorify God? One deep desire we have had for your family is to live a debt free life. Here are 5 tools that can help you to either A. Gain Financial Freedom or B. Use in your monthly financial planning for your family.

1. Let's Get Organized!

We've all had those moments of utter frustration when we can't find a bill that we know is do or needing record if we have paid a bill. Being organized is essential in getting out of debt.

There is the cutest Organizing Planner that is free to print out and even better it's CUSTOMIZABLE with your family's name and details.

Remember if you print it you need to punch holes and put it in a 3 ring binder. I did this a few years ago and it's amazing how much easier it is to stay organized. Click HERE for the Organizing Planner.

2. Know What You Owe!

I found this really cute Expense Detail log HERE. There is an entire set that is free to print including a binder cover and Monthly budget worksheet.

Knowing what all of your outgoing expenses are each month is the first step in getting out of debt. Taking it a step further, knowing how much your revolving debt is and what it will take for you to become totally debt free.

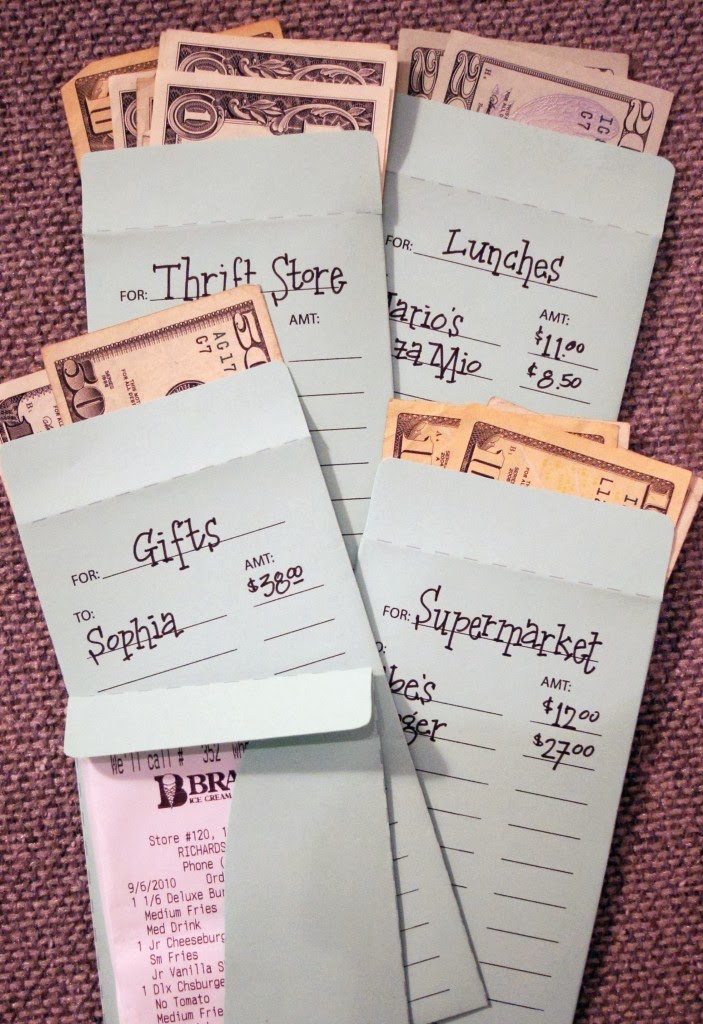

3. Know What You Spend (And do it in Cash)!

Your less likely to make large, unwise or un-necessary purchases if you commit to paying in cash for the things your family needs.

You can find many envelop printables on pinterest or click HERE for this version. A simple white envelop with lines drawn on will do the trick as well.

The main purpose is to help make you more aware of what your outgoing expenses are and what your spending.

4. Know What You Make and Start Budgeting!

Isn't this a cute Printable (Click HERE to print)! I'm much more likely to use worksheets if they are eye appealing personally.

If you have never created a budget it can be a bit overwhelming - but it's crucial in getting out of debt.

First you must be honest with yourself as to how much money you bring in each month and then how much is going out. This will help you to see where you might need to make a few cuts.

5. Calendar in Payments!

After you have created your budget you can now decide when to pay each outgoing expense. If you get paid weekly for example, I find that it's best to break down your expenses throughout each week.

If all of your bills are due at the beginnning of the month contact your debtors and see if you can change the due date. You will most likely find they will work with you.

Here's to getting out of debt and being in control of your finances!

No comments:

Post a Comment